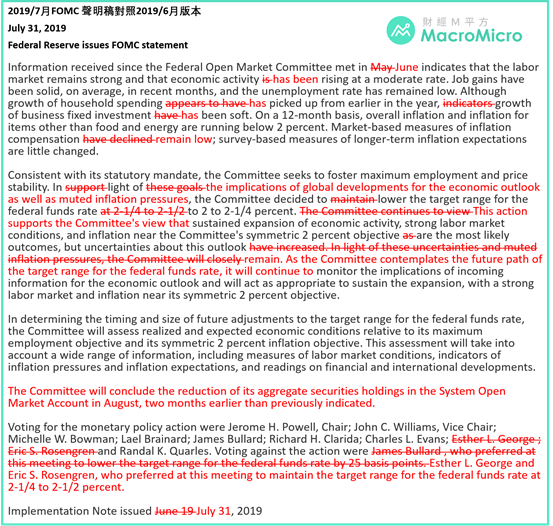

縮表部分,8/1起結束美債贖回(原定9月),並提早2個月重啟購債,MBS贖回超過200億/月部分將按SOMA持有流通在外美債期限再投資於美債。(原文:The Committee will conclude the reduction of its aggregate securities holdings in the System Open Market Account in August, two months earlier than previously indicated.)

降息投票以8:2通過,2位鷹派委員投票反對降息

本次下調聯邦基準利率1碼以8:2投票通過,其中極鷹派委員Rosengren、Esther George反對降息1碼,符合市場預期。(原文:Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against the action were Esther L. George and Eric S. Rosengren, who preferred at this meeting to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent.)

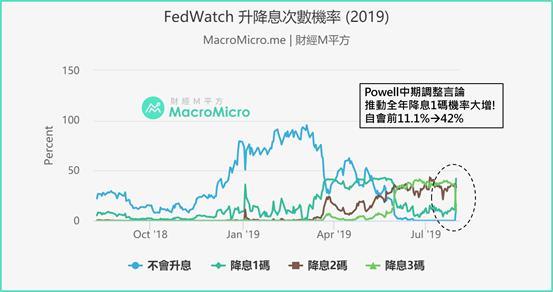

利率會議後,FedWatch顯示2019全年降息3碼自會前36.5%大幅下滑至8.2%,全年降息2碼機率自35.1%小幅下降至33.6%,而全年降息1碼機率自11.1%大幅上升至42%!

同時,9月維持利率不變機率自32.6%攀升至56.5%,而再降息1碼機率甚至自會前55.1%跌至0%!顯示Powell記者會中期調整(mid-cycle adjustment)言論,釋放聯準會降息後將保持中性態度訊號,使市場短期鴿派預期有所收窄。

三、縮表計畫提前結束,聯準會即日起重返購債

聯準會在2019/3月份會議正式給予市場縮表時間框架(詳見部落格),確定自5月起降低美債到期贖回的再投資上限至150億(原:300億) ,並於9月底結束縮表計畫,同時維持機構債與MBS的贖回,10月後再將MBS贖回部分再投資於美債(限於再投資上限200億/月以內,購買美債期限與流通在外到期一致)。